We're here for you.

At Cartier Agency, we know that sometimes insurance is the last thing on your mind when it comes to running your trucking company. Through technology investment and our industry-trained and certified staff, we have made the insurance process efficient and painless. We are trucking insurance and are devoted to serving fleets of any size in the transportation industry.

Keys to insuring your interests

Reports

- "Fleet Safety Management" – Compliance, Safety, and Accountability (CSA), the data and analytics on your Safety Measurement System (SMS)

- Workers' compensation auditing

- Experience mod analysis

- Claims reports analysis

- Driving record reports

Agency services

- Expansive coverage analysis

- Evaluate current coverages to ensure you're properly protected and engage multiple trucking-specific carriers

- Online customer portal allowing you to access your certificates, auto ID cards, and policy information

- Team that stays on top of insurance industry trends, laws, regulations, and technologies

Claims

- Claims team that works with you and the insurance company to close claims efficiently, getting you back on the road

- Engage multiple insurance carriers that specialize in your industry

Safety services

- Safety expertise

- Safety and compliance services

- Availability for an on-site safety inspection to help you prepare for your annual DOT inspection

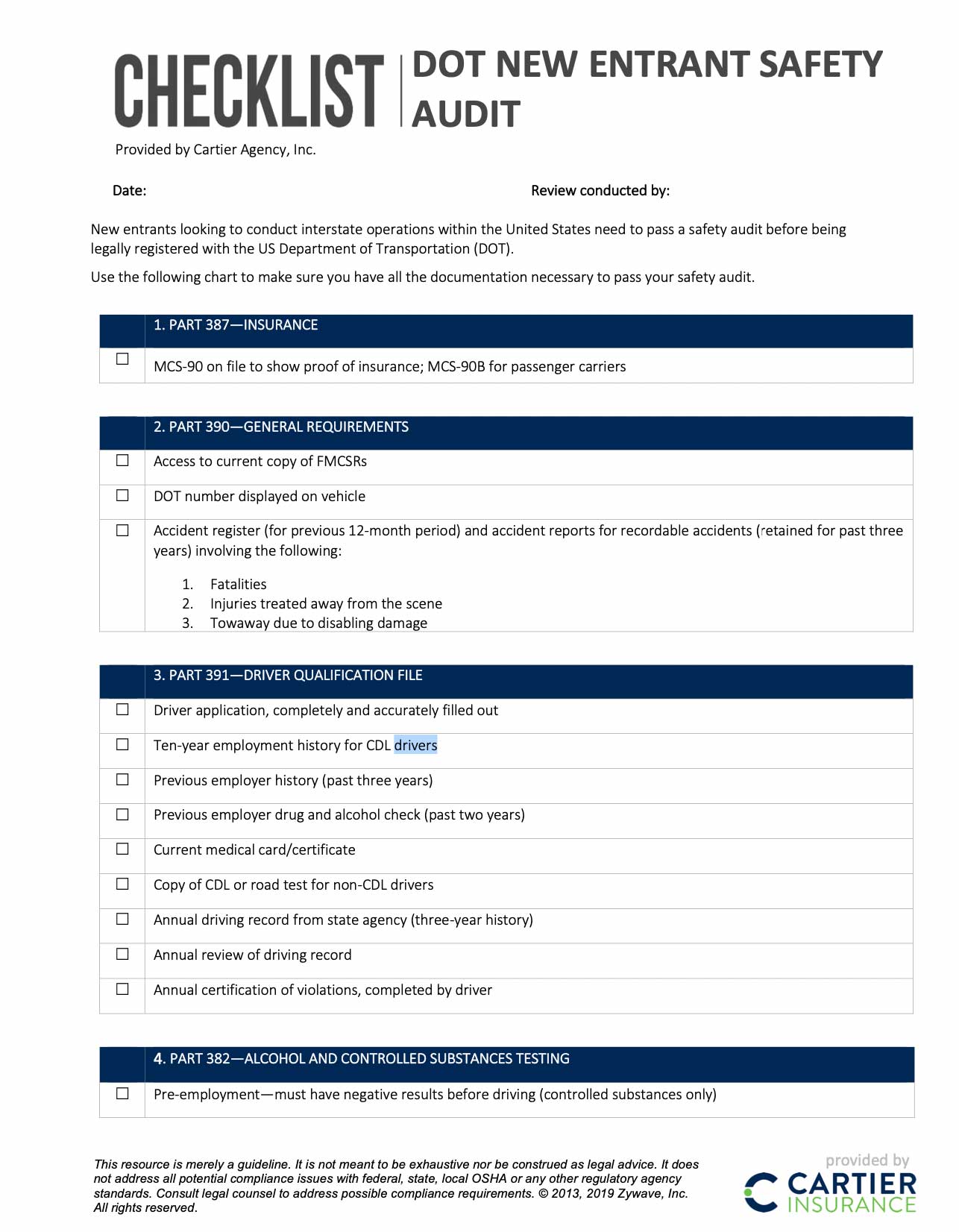

Keep your organization in compliance.

Download our guide to the Department of Transportation's federal motor regulations and ensure your organization is in compliance and protected.

DownloadOur trucking insurance coverage options include:

This is a sample of our coverage options. Contact us to learn about our comprehensive services.

Request a quoteAuto liability coverage provides insurance to cover loss from the insured's legal liability for bodily injury and property damage to another party. The Federal Motor Carrier Safety Administration requires this coverage to activate your operating authority.

Auto physical damage coverage provides insurance to cover loss or damage to an insured vehicle. This coverage is typically offered on a stated value basis, allowing you to customize your policy to reflect your vehicle's true worth.

Motor truck cargo insurance provides coverage against loss from legal liability for damage to goods or merchandise in the insured's care, custody, and control in the ordinary course of transit. Some available coverages include debris removal, earned freight, and refrigeration breakdown.

General liability protects you against liability claims for bodily injury and property damage arising out of premises, operations, products, and completed operations, as well as advertising and personal injury liability.

Umbrella liability insurance gives your business additional coverage when a claim exceeds an underlying policy's insurance limits. Coverage can be extended over coverages such as general liability and auto policies in increments of $1,000,000.

Workers' compensation coverage can replace lost wages, pay for medical treatment and protect your business and its assets if an employee suffers an injury.