Ensure your peace of mind.

Over the years, we invest a lot into our personal lives. We have houses, cars, recreational toys, and investments in hobbies. Insuring these items can be complicated, so at Cartier, we try to simplify the process by putting everything on one policy. It doesn’t matter if you are into ATVs, boats, jewelry, guitars, motorcycles, or bicycles; we can find the right personal policy for you.

At Cartier, we focus on prompt and efficient service, knowing that you want to spend time enjoying your life and hobbies, not managing your insurance. Through technology investment and continued staff training, we have made the insurance process efficient and painless.

Keys to insuring your interests

Reports

- Claims reports analysis

- Home replacement cost evaluation

- Driving record reports

Agency services

- 24/7 service with access to policy changes, coverage verification, and premium evaluation

- Team that stays on top of insurance industry trends, laws, regulations, and technologies

Expansive coverage analysis

- Evaluate current coverages to ensure you are properly protected

- Engage multiple package carriers

Claims

- Claims team that works with you and the insurance company to close claims efficiently, so you can focus on the things you love to do

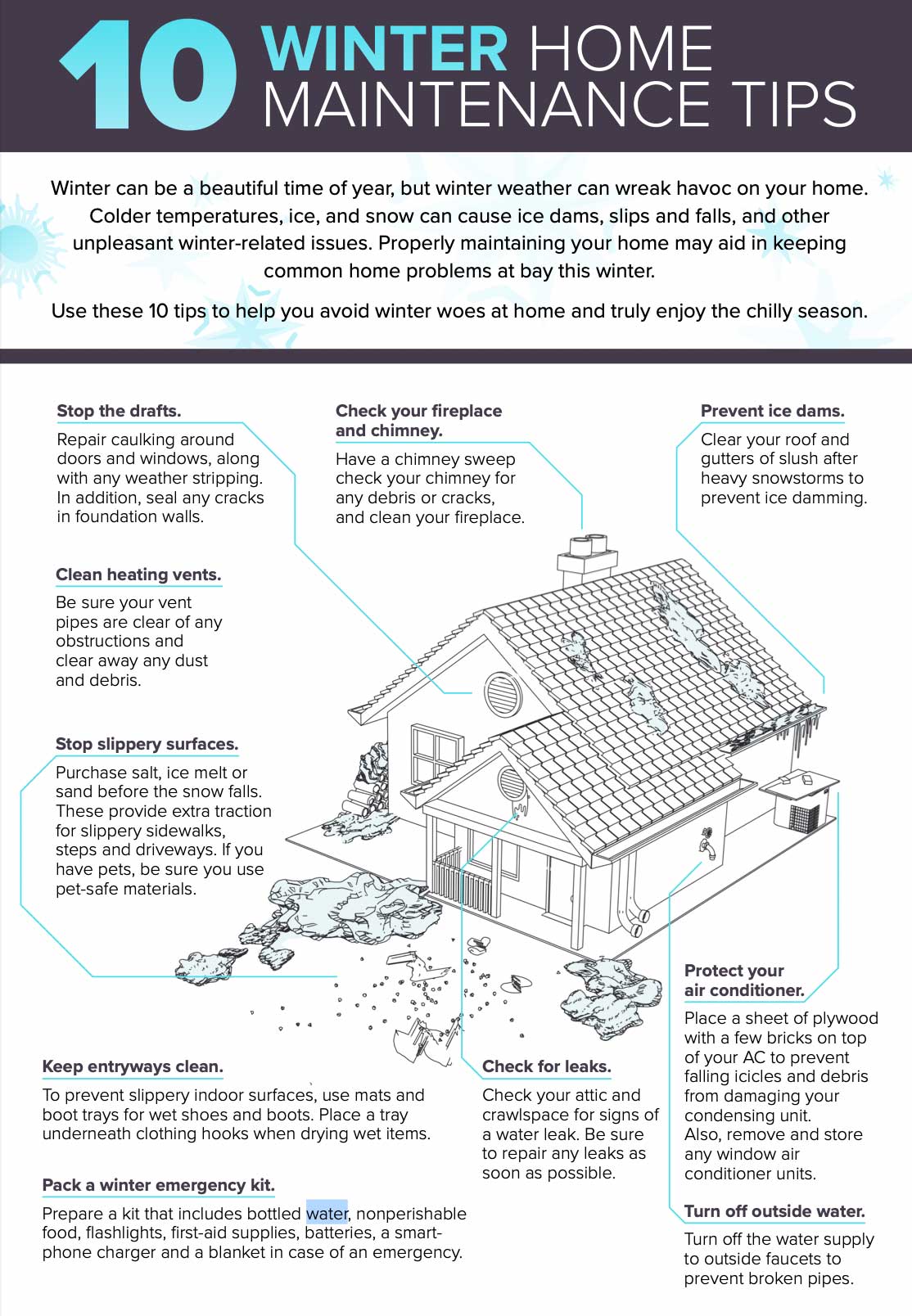

Protect your home from common hazards.

Download our guide to learn how to protect your home and family from the most common household hazards. Regain peace of mind knowing your home is protected.

DownloadOur home & auto coverage options include:

This is a sample of our coverage options. Contact us to learn about our comprehensive services.

Request a quote